Franklin County Va Real Estate Assessments

Real Estate

REAL ESTATE TAXES General Information Real estate taxes are assessed as of January 1st of each year. Real estate is billed semi-annually. A 10% penalty is added on June 6th and December 6th for late payment. Interest is 10% annually and begins accruing the first day of the month following the due date.

https://franklinvatax.com/realEstate

Bland County Helping Hands I just had my call from the assessor gentleman Facebook

One thing he pointed out was VA Code 58.1-3321 as an informative code that does NOT appear (as far as I have seen) on the mailed Reassessment Letter. In addition to the codes listed on the letter, 3321 outlines what the Board of Supervisors must follow in determining our 2026 tax rate. (At least that is what I believe he said.)...

https://www.facebook.com/groups/220254232427201/posts/1570229297429681/

On Wednesday, the Franklin County Commissioners presented the county’s 2026 proposed budget of $154.2 million for consideration. The total property tax millage rate remains unchanged at 29.1 mills and consists of general operating millage of 25.0 and debt service millage of 4.1.

https://www.instagram.com/p/DRR-VYekqbC/

Fy 2025-2026 Budget Work SeSSion ...

FY 2026 Projection. Change. Percent. Change. General Property Taxes ... ❑ Real Estate and Personal Property are trending under budget for ...

https://www.franklincountyva.gov/DocumentCenter/View/5514/Budget-Work-Session-Presentation--1-21-25-with-Board-of-Supervisors“I can’t pay it.” Potential major property tax increase leaves people in Franklin Co. in an uproar

FRANKLIN COUNTY, Va. (WDBJ) - Many people in Franklin County are experiencing sticker shock after recently receiving their property valuations. The last property assessment was conducted in 2020 and this year’s assessments have more than doubled for some people, which has them fearing their tax bills will go up.

https://www.wdbj7.com/2024/02/05/i-cant-pay-it-possibility-major-property-tax-increase-leaves-people-franklin-county-an-uproar/

Star News TV - PACKED HOUSE Citizens turnout for... Facebook

I understand that values go up but double!!! ( which is about a $100 more a month) and then have the idiot response " well in 2021 it was during COVID and we couldn't get out to do a reassessment, ( they didn't come out this time )oh but now you can sell and get a higher sale price for your house" now that's an intelligent response that's makes us...

https://www.facebook.com/StarNewsTV/posts/packed-house-citizens-turnout-for-understanding-the-2026-real-estate-property-as/1390005326475145/Franklin County, VA Property Tax Calculator 2025-2026

Calculate Your Franklin County Property Taxes Franklin County Tax Information How are Property Taxes Calculated in Franklin County? Property taxes in Franklin County, Virginia are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.57% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/virginia/franklin-county

Franklin County Real Estate Tax Change - Here's Everything You Need to Know

We’re all busy, and we all get tons of mail. Sometimes that means important information can get overlooked. Like the fact that Franklin County (Virginia) changed how it bills real estate taxes. This is critical information if you already own a house here, but also important to know if you are looking at homes for sale in Franklin County, VA.

https://debberanproperties.com/franklin-county-real-estate-tax-change/

Assessor Franklin County, WA

Assessor Public Notice Notice is hereby given that the Franklin County Open Space Current Use Advisory Committee Meeting will be held on Tuesday, February 10th, 2026 at 9:00 AM at the Franklin County Courthouse, 1016 N. 4th Ave, Commissioners Meeting Room, Pasco, Washington.

https://www.franklincountywa.gov/157/Assessor

Home

As the Treasurer of Franklin County and on behalf of my staff we would like to welcome you to the Franklin County online property tax website. We are very proud of our beautiful scenic county, but we feel it is our people that make us such a wonderful place.

https://franklinvatax.com/

Franklin County Auditor - Homestead

Overview The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden by shielding some of the auditor's appraised value of their home from taxation. The exemption takes the form of a credit on property tax bills.

https://franklincountyauditor.com/real-estate/homestead

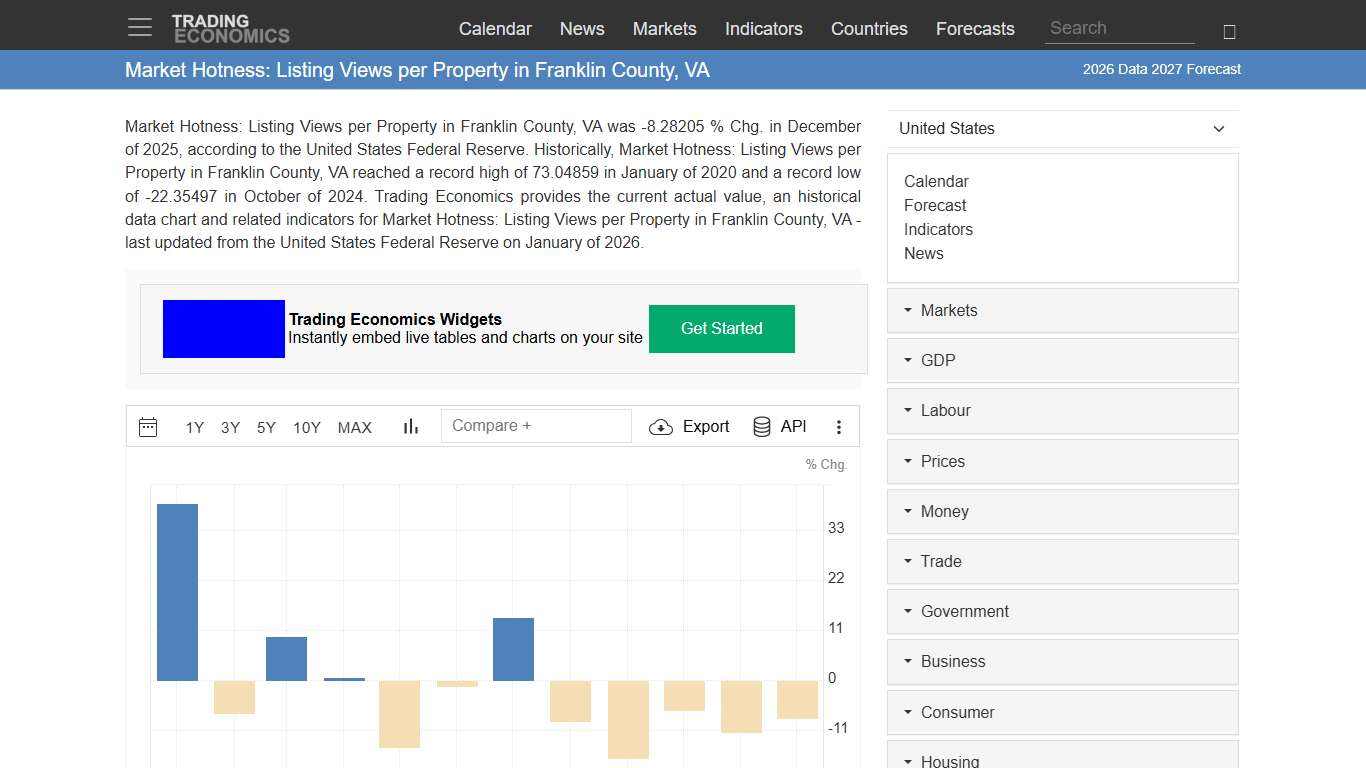

Market Hotness: Listing Views per Property in Franklin County, VA - 2026 Data 2027 Forecast

Market Hotness: Listing Views per Property in Franklin County, VA was -8.28205 % Chg. in December of 2025, according to the United States Federal Reserve. Historically, Market Hotness: Listing Views per Property in Franklin County, VA reached a record high of 73.04859 in January of 2020 and a record low of -22.35497 in October of 2024.

https://tradingeconomics.com/united-states/market-hotness-listing-views-per-property-in-franklin-county-va-percent-change-fed-data.html

Franklin County Public Access - Owner Search

Tax District. -Any-, PP, REAL. -Any-, BRASSFIELD, BUNN, BUNN FIRE, CENTERVILLE ... Data Franklin County Assessor's Office Last Updated: 23/Jan/2026

https://www.franklincountytax.us/search/commonsearch.aspx?mode=owner

Have questions about the 2026... - Henry County, Virginia Facebook

This is absurd!!!! I wish I could get a 67% rate increase in one year! This show is being produced, directed and shown by an inexperienced group of people with no clue about how it affects the community with a blow like this. Lastly!!!! Give Me A Break,,,, Lastly!!!!

https://www.facebook.com/HenryCountyVA/posts/have-questions-about-the-2026-real-estate-reassessments-watch-the-linked-video-f/1329240865909018/